tax benefits of retiring in nevada

You can add benefits or modify terms before you finalize an annuity contract but a bond indenture cannot be changed. The Medicare portion HI is 145 on all earnings.

How To Reduce Taxes In Retirement Accuplan Benefits Services

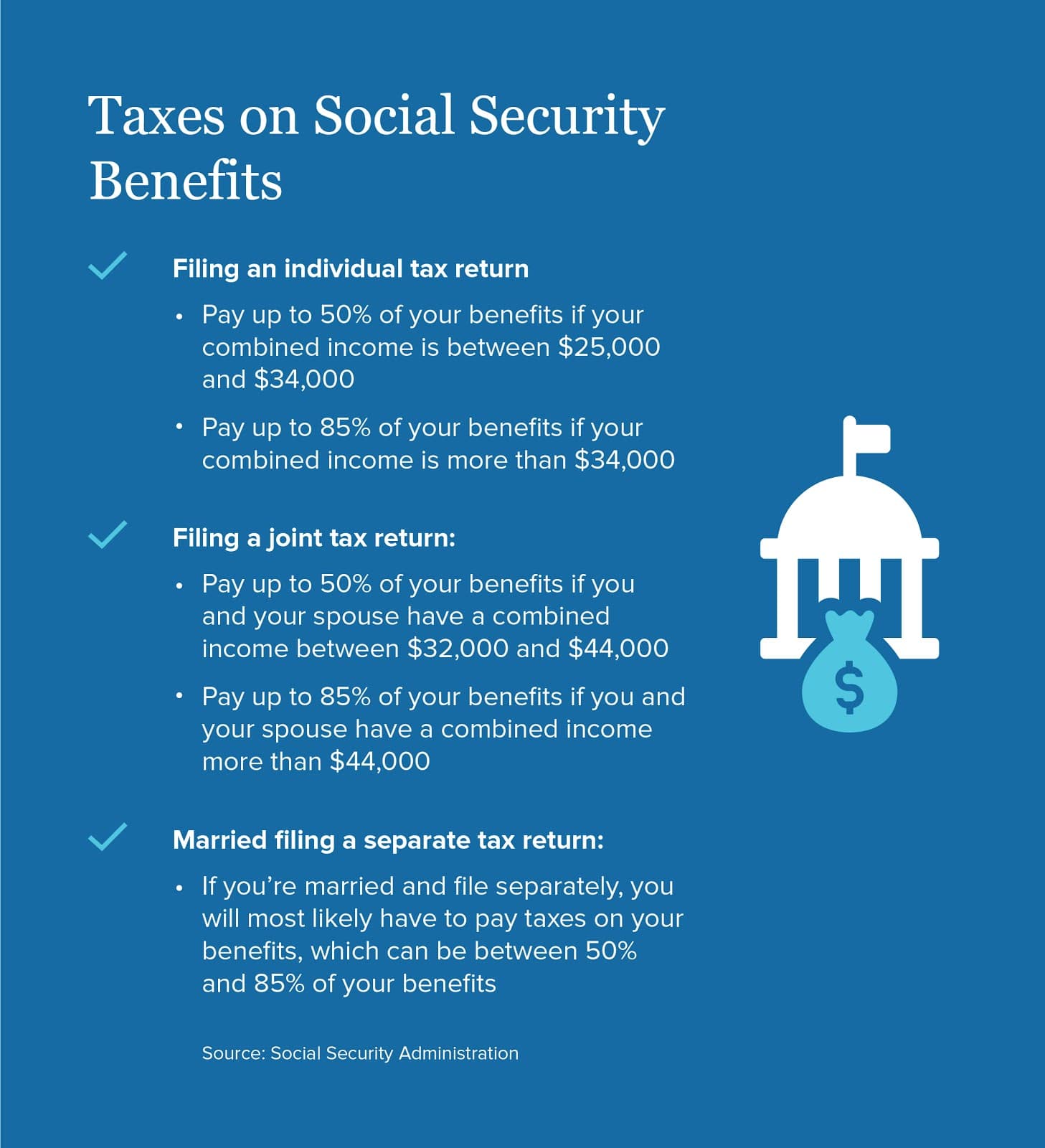

These 38 states dont have Social Security benefit taxes.

. Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas Washington or Wyoming. The bill which would create a state council to establish minimum pay and safety conditions was the subject of a. Social Security Benefits.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. The state sales tax is under 5 although county taxes. The influx of new residents combined with tourists can cause crowding even in small towns.

Mississippi doesnt tax Social Security benefits either so you can spend more of your retirement check on catfish and Mississippi mud pie. DealBook Newsletter California Bids for Tighter Rein on Fast-Food Chains. Nevada is also in the bottom half 28th highest when it comes to property tax collections with the property tax being paid at 084 percent.

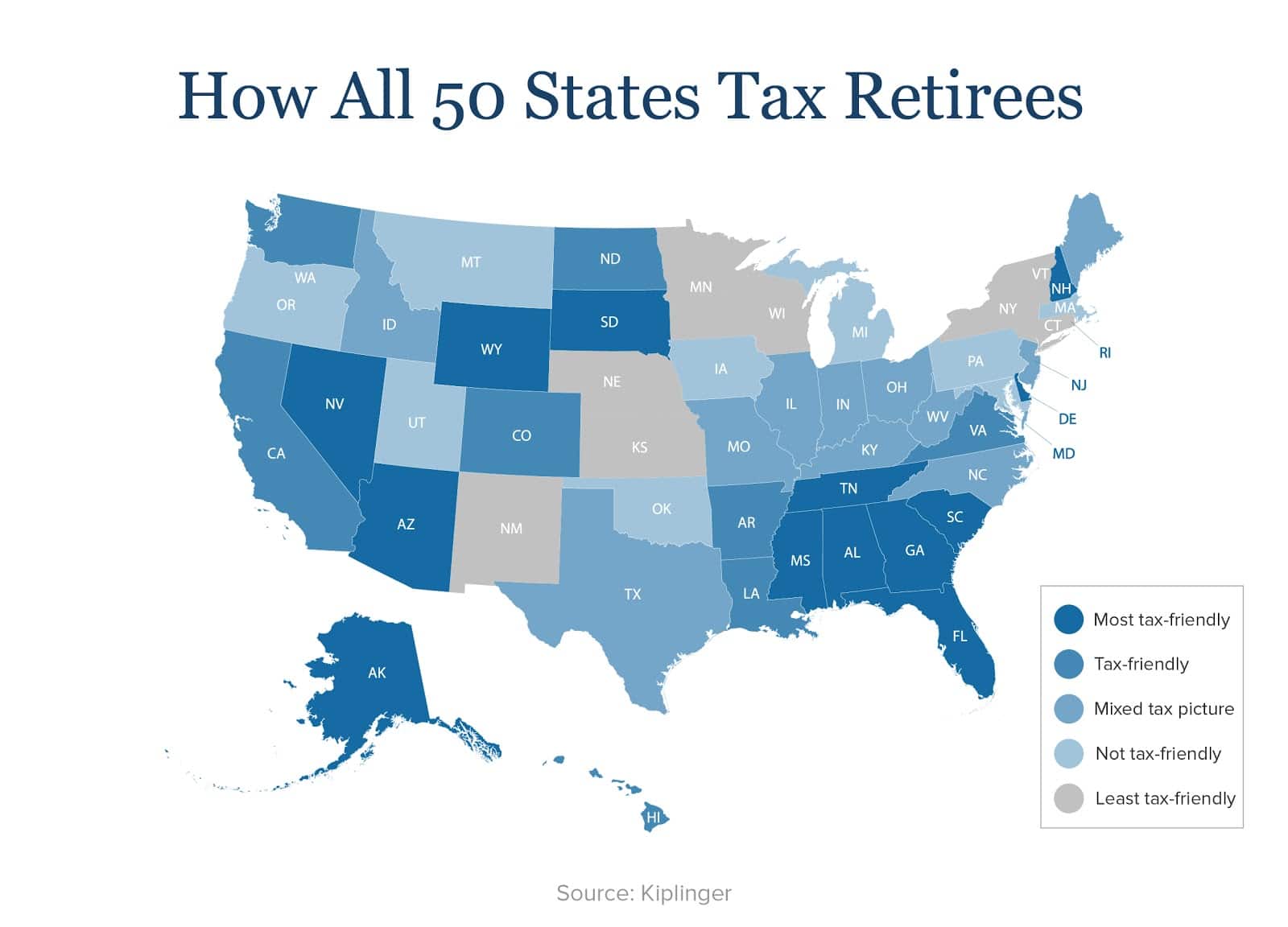

Select a state from the menu above to learn about existing tax burdens where you want to retire. The income cap normally 400 of the poverty level for subsidy eligibility has been eliminated through the end of 2022People with income above 400 of the poverty level can qualify for a premium subsidy if the cost of the benchmark plan would otherwise be more than 85 of their household income. He ran for the United States Senate in 2016 losing to.

Paying the median home price is out of reach for some retirees. If youve got questions about the retirement system in Nevada youre not alone most have questions ranging from how benefits are calculated to if the plan benefits. Nine states include Social Security benefits in taxable income but they provide exclusions exemptions and deductions.

Also as of January 2013 individuals with earned income of more than in Medicare taxes. The new 15 percent minimum tax would apply to corporations that report annual income of more than 1 billion to shareholders on their financial statements but use deductions credits and other. Typically you receive deferred compensation after retiring or leaving employment.

Nevada can be a great place to retire if you want a warm climate and access to Las Vegas. Careful retirement planning is especially important if youre among the 40 of teachers who wont receive Social Security benefits. But before you make a point to avoid those 13 soon to be 12 states that do tax benefits there are other factors it pays to look at.

If you choose to name a charity as your beneficiary then the proceeds are free from income tax. For many however it can be somewhat confusing and arcane trying to understand what the system is and exactly how it works. Nevadas general and retiree population continues to increase year after year.

Going to a higher tax bracket means higher taxes. Joseph John Heck born October 30 1961 is an American physician and politician who served as the United States representative for Nevadas 3rd congressional district from 2011 to 2017. Military retirement pay is partially taxed in.

An option with a lower tax exposure is to have the death benefits paid over the life expectancy of the beneficiary. And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Thirty states exempt all Social Security benefits from taxation.

The sales tax is a 21 tax on consumer goods that is usually included in the price. Although tax-advantaged retirement plans such as 401k accounts are technically deferred compensation plans the term deferred compensation in general use. What if I am retiring out of the area.

For one thing look at each states cost of living. Annuities also have the advantage of being tax-deferred while bond income is taxable. This means that benefits will be paid out over a longer period of time.

Up to 2000 of retirement income. 20000 for those ages 55 to 64. Today on Insight were looking at what the Inflation Reduction Act means for California the states Supreme Court Chief Justice is retiring this fall and we hear about the Nevada County Film.

Nine states currently have no tax on regular or retirement income. In the long term annuities typically show better rates of return than bonds and annuities tend to hold their carrying value better over time. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below.

Deferred compensation refers to money received in one year for work performed in a previous year often many years earlier. The sales tax in this state is 685 percent although it can go up as high as 81 percent in certain localities. 8-10-2022 Item 7 Managed Accounts Benefits Brochure for Employers 8-10-2022 Item 7 Morningstar Retirement Manager Participant Overview.

Your pension probably wont cover all your needs in retirement. Income tax is progressive and the rates for national and local income tax are usually between 19 and 48. Nevada has no income tax and property taxes are low.

There is no estate or inheritance tax in the state of Nevada either. PERS is an important resource for employees of the state in Nevada. Up to 3500 is exempt Colorado.

The 765 tax rate is the combined rate for Social Security and Medicare. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Heck is a United States Army major general and a board-certified physician who previously served as a Nevada state senator from 2004 to 2008.

Residents of New Hampshire dont have to pay state income tax on Social Security benefits pensions distributions from retirement accounts or income earned from a. Taxes on Retirement Benefits Vary From State to State. Plus its one of the handful of states that dont levy a personal income tax.

Each state has a different mix of tax breaks for retireesmost exempt certain types of retirement income but they tax others. The following 38 states dont tax the Social Security benefits of any of their residents. The percentage of income that people have to pay for the.

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. What is the maximum amount of pre-tax dollars that I can contribute to an HSA. A lack of tax.

States That Don T Tax Retirement Income Personal Capital

Choosing A Retirement Destination Tax Considerations Lvbw

Nevada Tax Advantages And Benefits Retirebetternow Com

How To Plan For Taxes In Retirement Goodlife Home Loans

37 States That Don T Tax Social Security Benefits The Motley Fool

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

37 States That Don T Tax Social Security Benefits The Motley Fool

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

10 Tax Deductions For Seniors You Might Not Know About

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)